- Inventory is classified as a current asset due to its short-term nature.

- Efficient management reduces holding costs, prevents stock issues, and meets customer demand.

- Poorly managed inventory strains financial health and turns into a liability.

- The inventory turnover ratio shows the liquidity and efficiency of inventory usage.

- Proper management prevents overstocking, obsolescence, and inefficiencies.

- Is Inventory an Asset?

- How Does Inventory as a Current Asset Work?

- Comparison Between Inventory vs. Other Asset Types

- Can You Depreciate Inventory?

- Does Inventory Count as a Tangible or Intangible Asset?

- Is Unsold Inventory an Asset?

- What Is the Difference Between Inventory Asset and Cost of Goods Sold?

- How Changes In Market Demand Affect Inventory As An Asset

- Frequently Asked Questions About Is Inventory an Asset?

Is Inventory an Asset?

Yes, inventory is an asset and classified as a current asset due to its short-term nature. It refers to goods or materials held for sale, in production, or being produced. Further, inventory is an essential aspect of a company’s operations and is integral to their financial statements.

For businesses, inventory is a key component of financial statements because it directly impacts profitability and cash flow. Therefore, efficient inventory management helps prevent increased holding costs and lost sales emanating from overstocking and understocking, respectively.

Thus, proper inventory management ensures operational efficiency and meets customer demand.

However, accurate inventory valuation is crucial to maintain accurate financial records. It directly affects a company’s balance sheet and income statement which influences profitability and tax liabilities. So, businesses need to assess their financial outcomes strategically to choose the right valuation method.

Some commonly used inventory valuation methods include:

- FIFO (First-In, First-Out): This method assumes that the oldest items are sold first and typically leads to higher profits during inflation.

- LIFO (Last-In, First-Out): This one assumes that the newest items are sold first and can reduce taxable income during inflation.

- Weighted Average Cost: This method calculates an average cost for inventory items, smoothing out price fluctuations.

These methods play a crucial role in accurately reflecting a company’s financial health and ensuring compliance with accounting standards, which ultimately impacts profitability and tax liabilities.

How Does Inventory as a Current Asset Work?

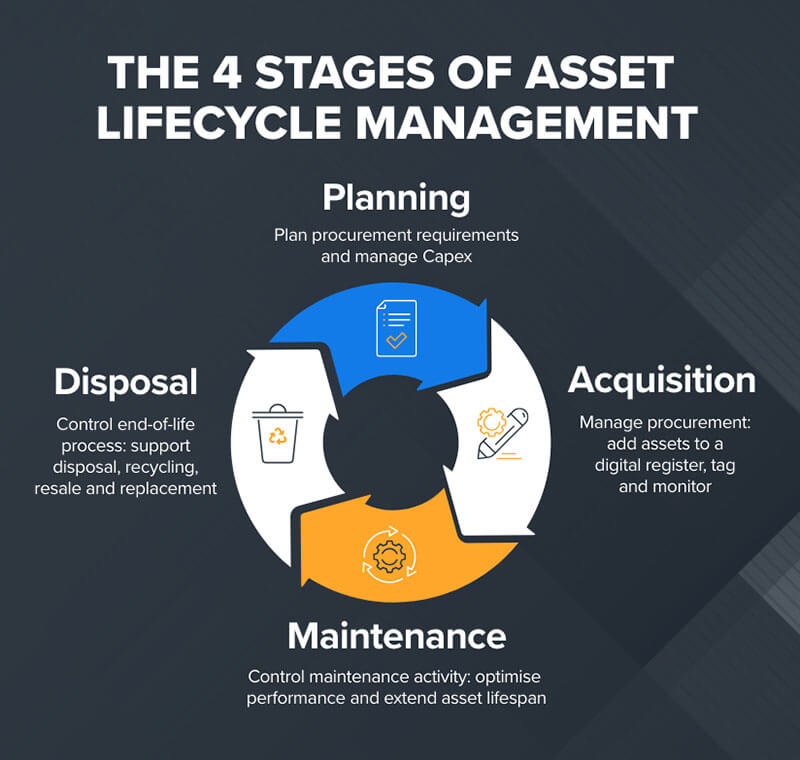

Inventory plays an important role in a business’s financial management and is typically classified as a current asset. This classification highlights the expectation of selling inventory within a year and converting it into cash to meet short-term financial obligations.

In other words, the inventory provides liquidity for businesses, allowing them to fulfill their immediate financial needs.

One way to measure inventory liquidity is through the inventory turnover ratio. This ratio compares the cost of goods sold (COGS) with the average value of inventory. Further, it also reflects how efficiently a company uses its inventory to generate sales. The formula for calculating this ratio is given below:

Inventory Turnover = Cost of Goods Sold (COGS) / Average Inventory Value

A higher inventory turnover ratio indicates better liquidity and financial health. It also shows that inventory is being sold and replaced quickly. This frees up capital for other business needs and helps maintain a balance between supply and customer demand. By closely monitoring and optimizing this ratio, businesses minimize holding costs, improve cash availability, and ensure smoother financial operations.

Is Inventory Always a Current Asset?

Yes. Inventory, typically in a business sense, is classified as a current asset and expected to be converted into cash within a year.

However, there are situations where inventory may not be classified as a current asset, such as unsold or excess inventory that takes longer to sell. This can impact its liquidity and potentially reclassify it as a non-current asset.

So, what determines whether inventory remains a current asset or not? Below are some factors:

- Inventory turnover rate: A faster turnover indicates higher liquidity.

- Operating cycle: Inventory sold within the cycle is considered a current asset.

- Market demand: Fluctuating demand for specialized or seasonal products can affect inventory’s liquidity.

Therefore, businesses must effectively manage their inventory to maintain its status as a current asset and support cash flow and profitability without tying up excessive capital.

This includes monitoring inventory turnover rate and adjusting production levels to match market demand. Thus, all this can help them better manage their cash flow and keep inventory as a current asset.

Comparison Between Inventory vs. Other Asset Types

When it comes to assets, inventory stands out because of its purpose and liquidity as compared to fixed and financial assets. While fixed assets like equipment and buildings are used for long-term income generation, inventory is classified as a current asset because it is intended for short-term sales or production.

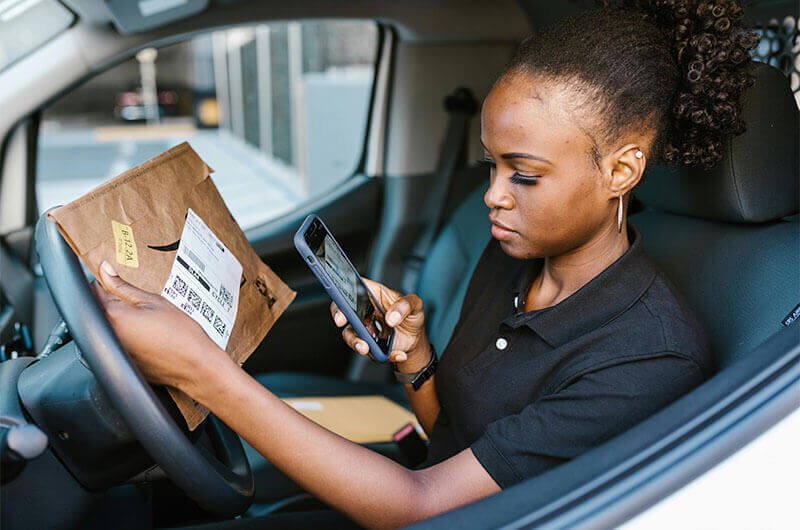

Furthermore, inventory plays a crucial role in driving short-term revenue and maintaining operational flow. This is evident from the success of companies like Amazon, Walmart, and Zara.

These companies excel in inventory management by implementing lean practices and demand-driven supply chains to efficiently align stock with customer needs.

However, proper inventory management goes beyond just boosting revenue. It also plays a critical role in preserving liquidity and ensuring that inventory contributes positively to the business.

Thus, neglecting to properly oversee inventory can lead to issues like overstocking or obsolescence, turning it into a liability.

To prevent such scenarios, businesses must optimize their stock levels and constantly monitor their inventory. This helps organizations prevent waste, reduce costs, and maximize the strategic value of inventory as an asset. Thus, this all leads to a more efficient and profitable operation for the business.

What Type of Asset Account Is Inventory?

Inventory is classified as a current asset in accounting systems, reflecting its potential to be converted into cash within a year. This essential asset category includes goods or materials held for sale, in production, and plays a significant role in financial statements, as well as overall business operations.

Key aspects of inventory classification include:

- Raw materials: Used in production.

- Work-in-progress: Goods being manufactured.

- Finished goods: Ready for sale.

When it comes to recording inventory transactions, businesses can choose between methods like perpetual or periodic systems. In these systems, purchases are directly recorded into the inventory account, while the cost of goods sold is updated each time inventory is sold. This ensures accurate reporting of costs associated with sales on the income statement.

But why is inventory so closely tied to the cost of goods sold (COGS)?

This is because COGS reflects the cost of inventory sold during a period, impacting profitability and financial reporting. Efficient management of inventory ensures accurate financial reporting and supports overall business health.

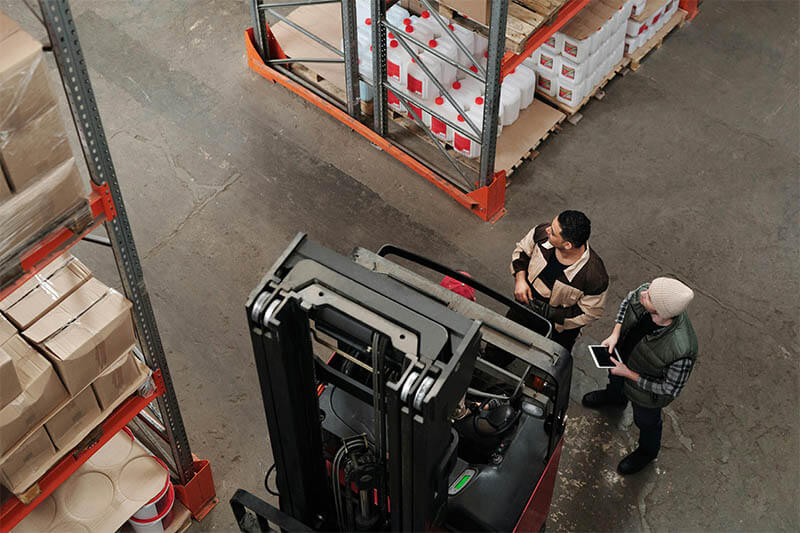

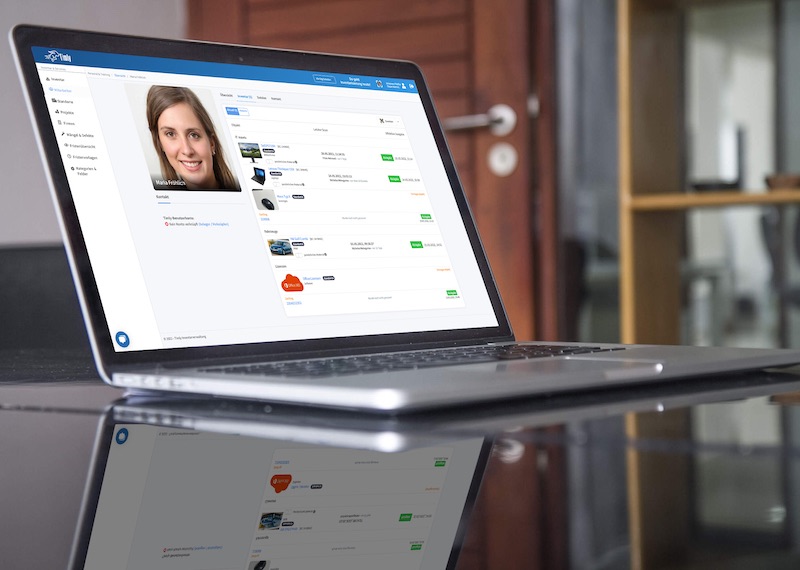

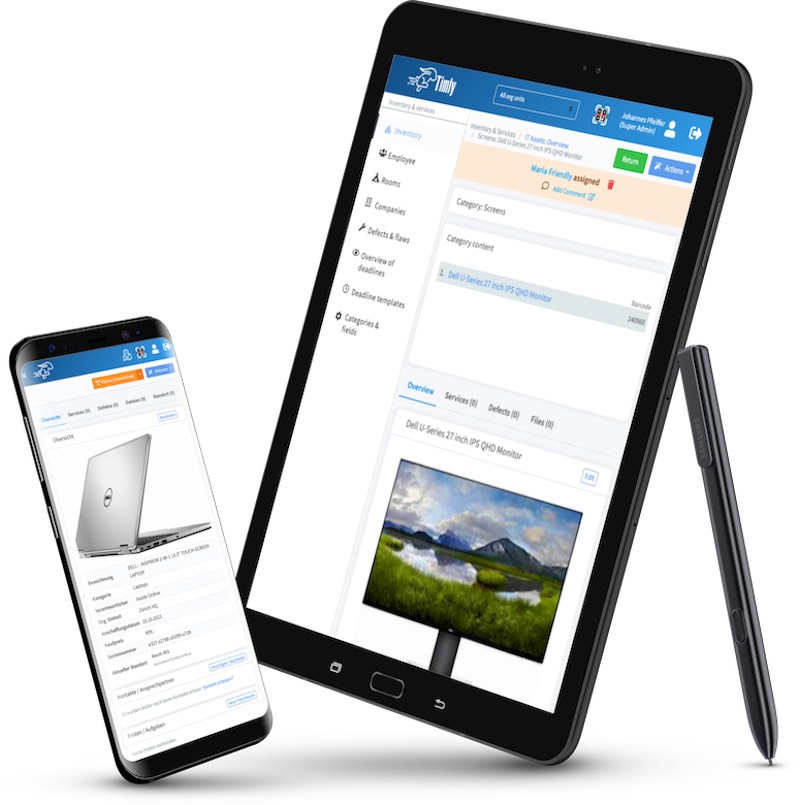

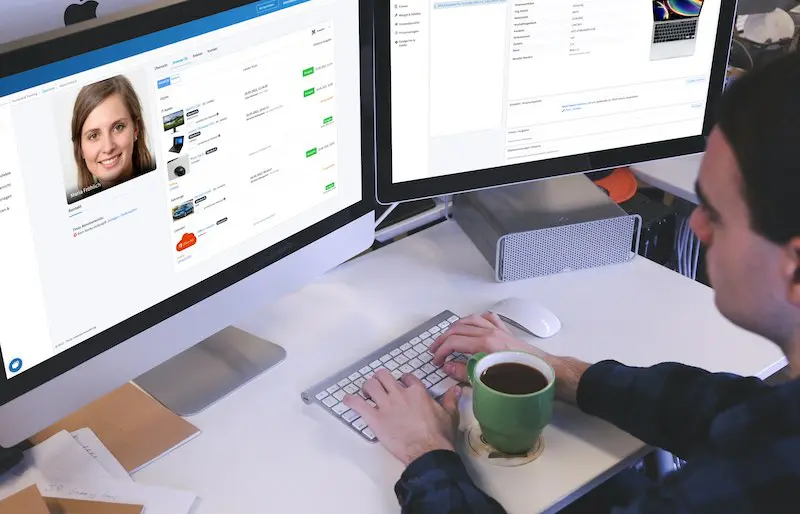

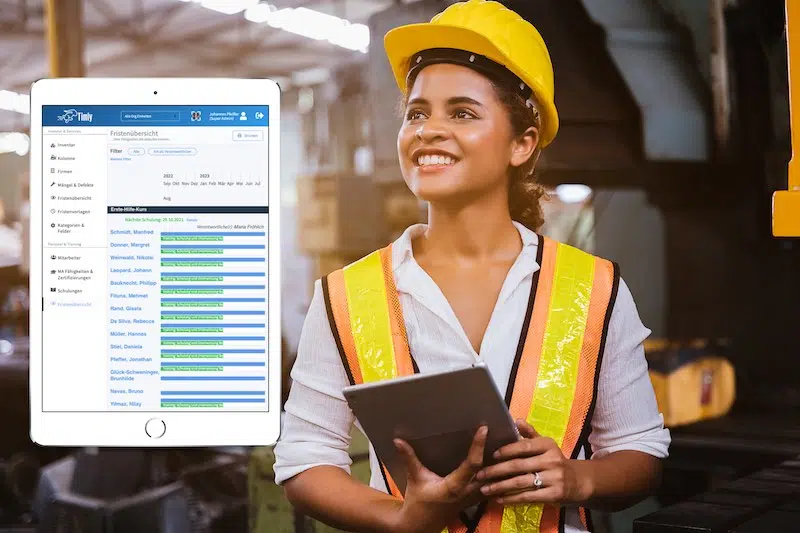

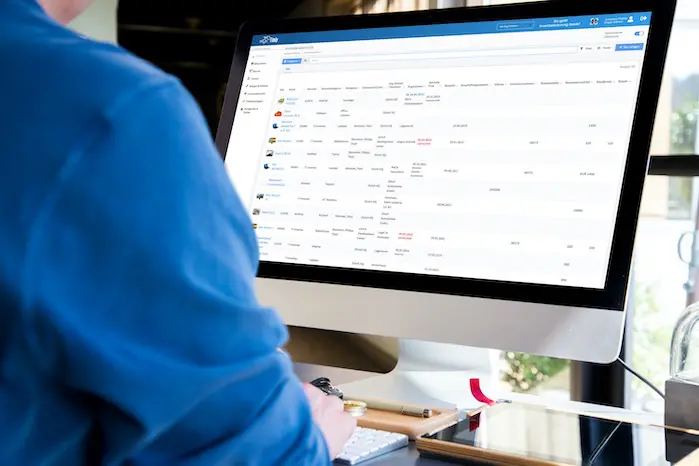

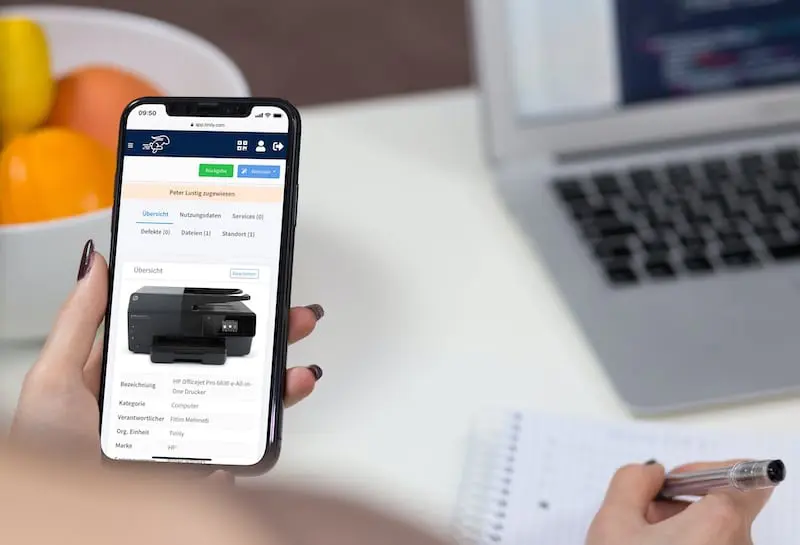

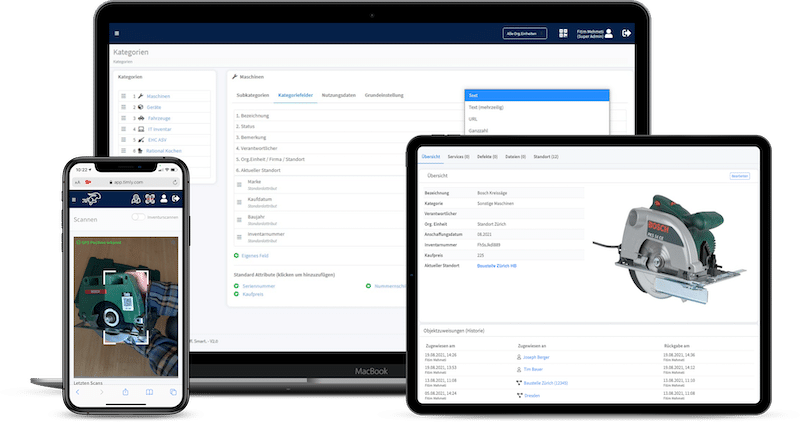

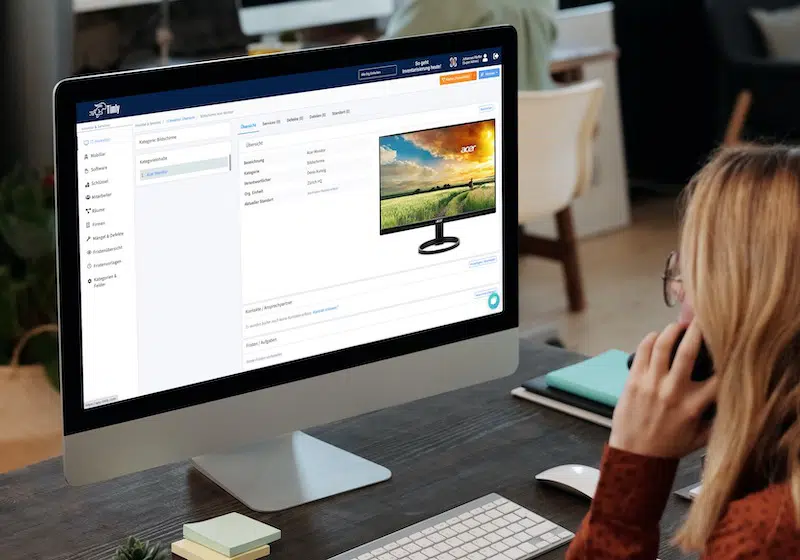

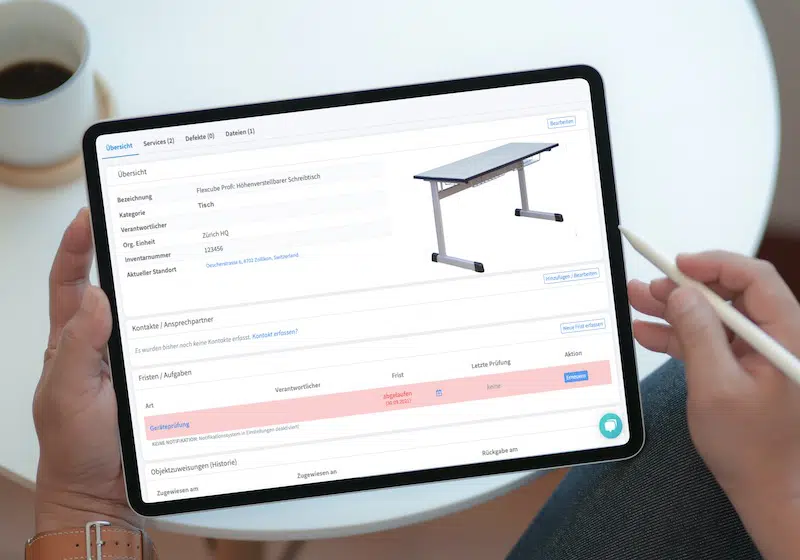

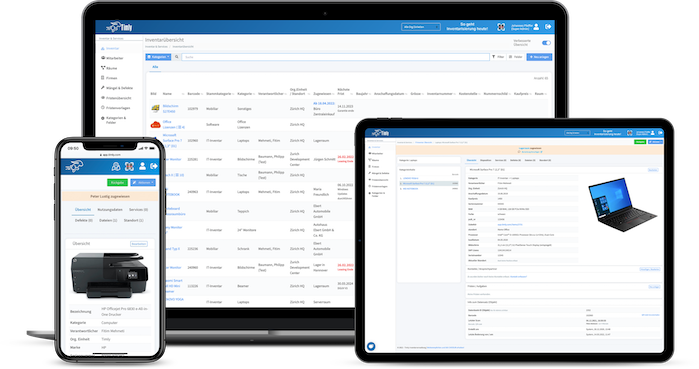

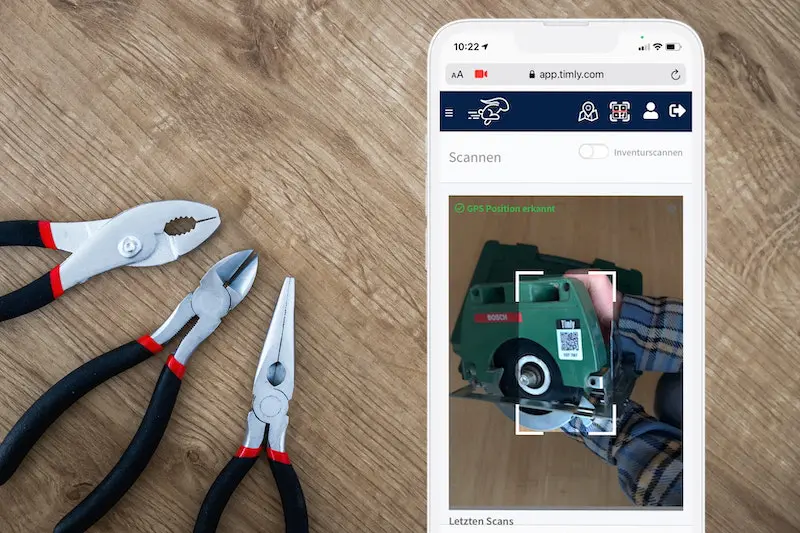

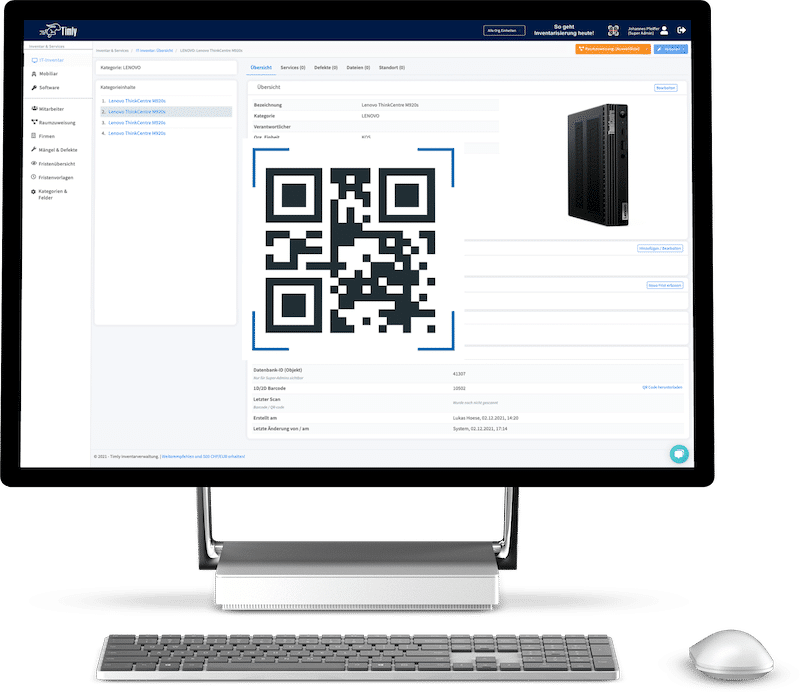

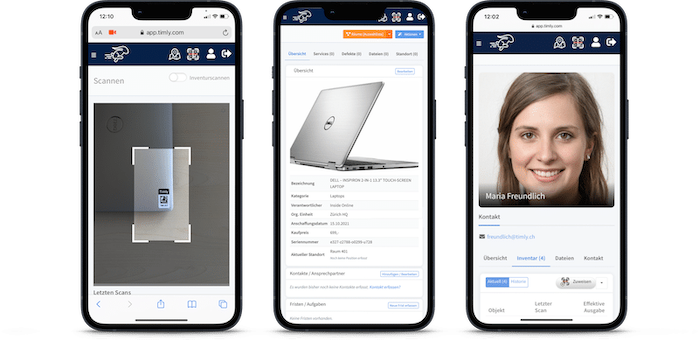

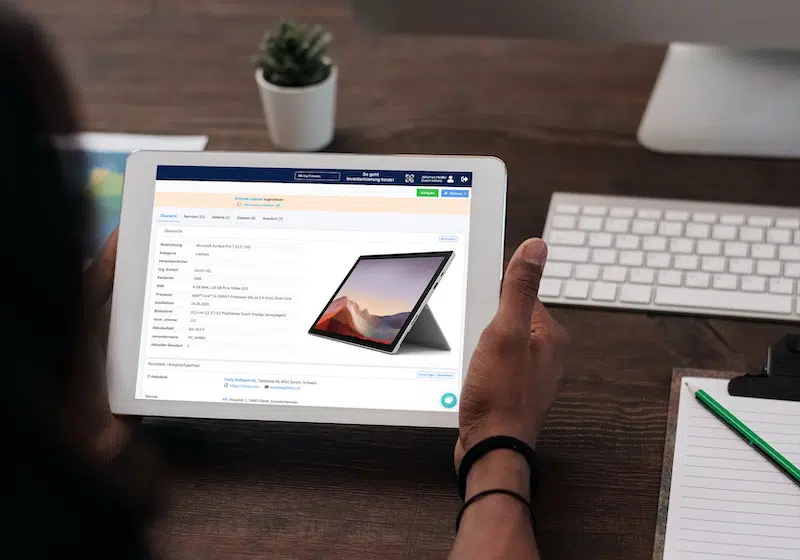

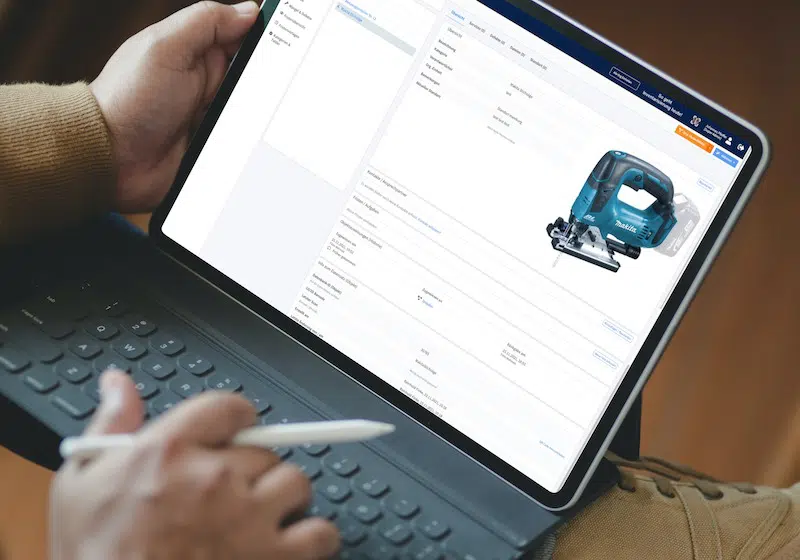

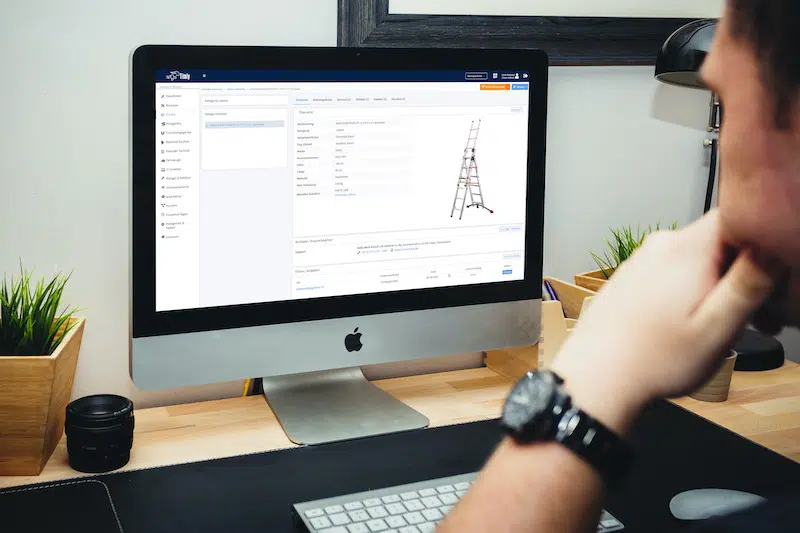

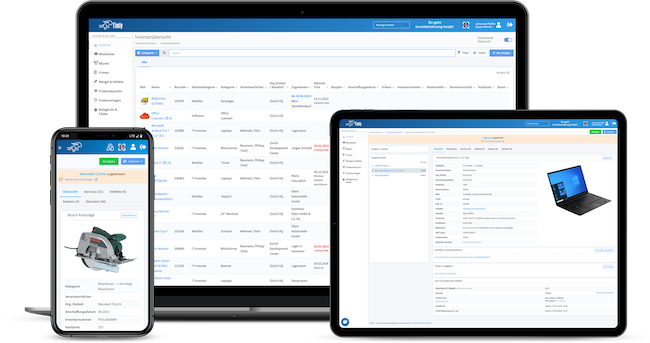

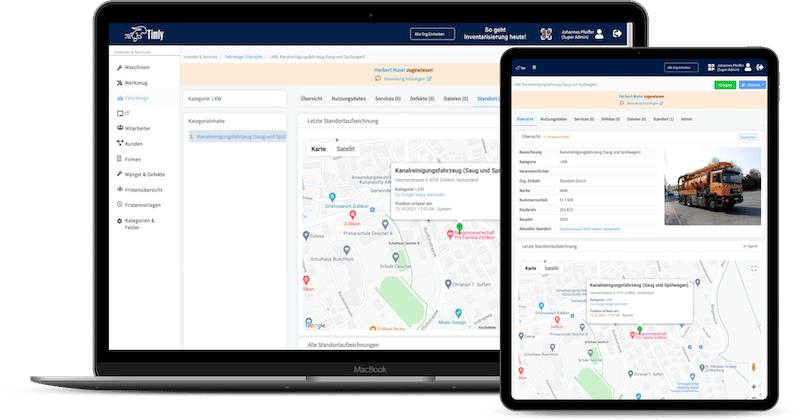

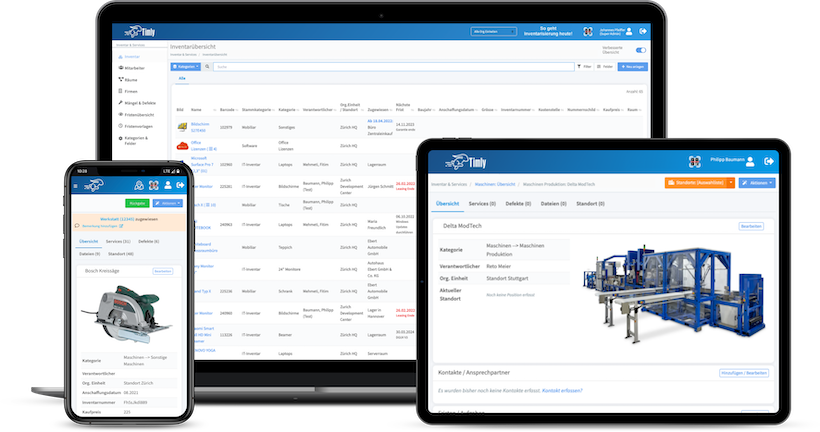

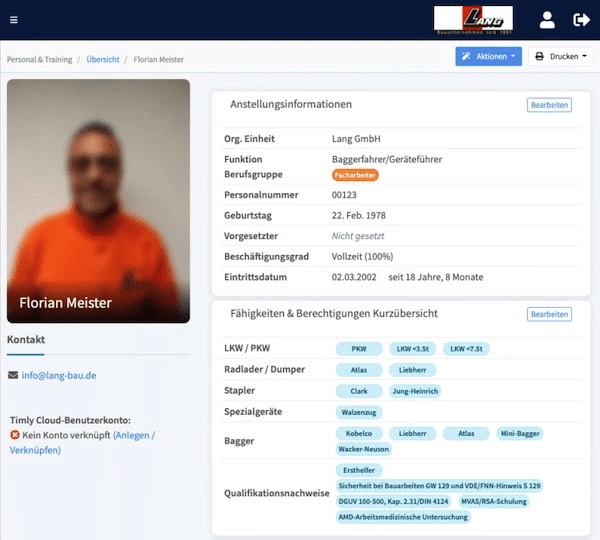

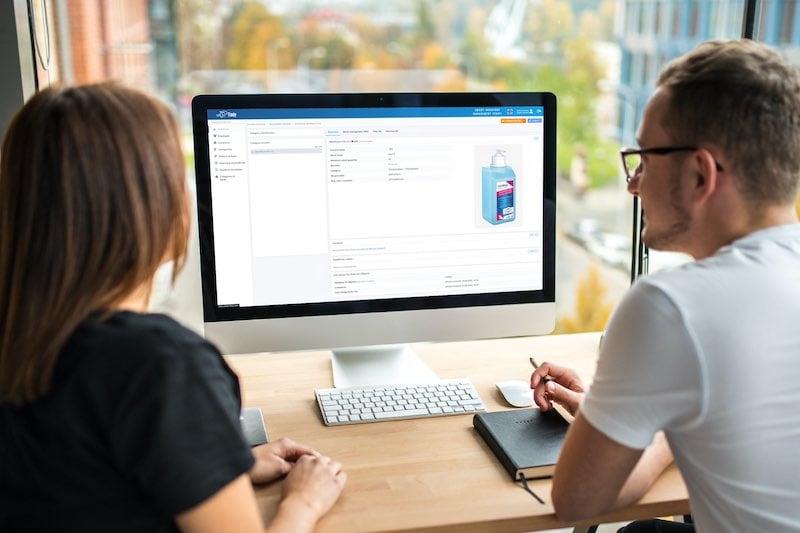

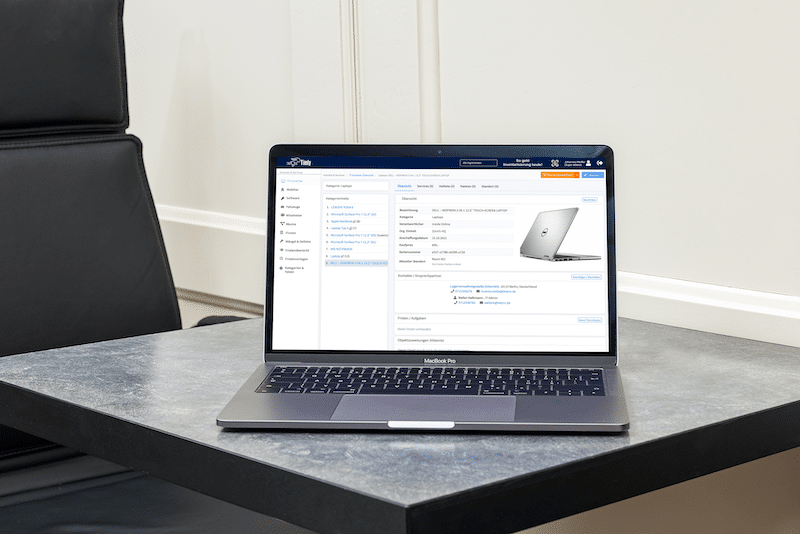

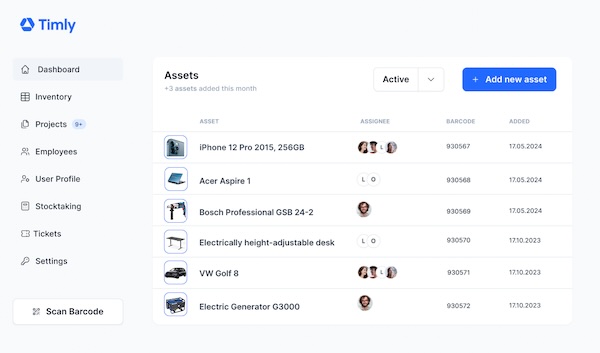

To effectively manage inventory and streamline accounting operations, businesses utilize inventory management software like Timly. With real-time tracking and centralized asset oversight, such software enhances financial clarity and reduces administrative effort.

Can You Depreciate Inventory?

No, inventory is not depreciated like other assets because its value and purpose are different. Unlike fixed assets, which are depreciated over their useful life, inventory’s value is adjusted through methods like FIFO, LIFO, or Weighted Average to reflect its current market value or cost.

The key differences between depreciation, amortization, and inventory valuation lie in their application and purpose. Depreciation applies to tangible assets like equipment, reflecting wear and tear over time. However, amortization is used for intangible assets, spreading their cost over their useful life.

Inventory valuation, on the other hand, adjusts inventory value based on market conditions, obsolescence, or damage. Businesses regularly adjust inventory value through inventory adjustments, which account for changes in quantity or value due to factors like obsolescence, damage, or market fluctuations.

These adjustments ensure that financial statements accurately reflect the current worth of inventory and support informed decision-making.

Does Inventory Count as a Tangible or Intangible Asset?

Yes, inventory is classified as a tangible asset. This is because it has a physical form that can be seen and touched.

To better understand asset classification, there are two major categories – tangible and intangible assets.

- Tangible assets refer to physical objects that can be seen and touched

- Intangible assets lack a physical presence but hold abstract value.

Inventory falls under tangible assets as it consists of physical items such as raw materials, work-in-progress, and finished goods.

This classification is vital because tangible assets like inventory contribute directly to revenue generation and support operational activities. As a tangible asset, the value of inventory can be quantified and effectively managed to ensure optimal business performance.

When Inventory Becomes an Intangible Concern

The value of inventory is often seen as reflecting its physical attributes. However, there are some cases where intangible factors play a significant role in influencing inventory valuation. These non-physical factors include branding and intellectual property (IP).

Branding, for instance, can greatly impact the perceived value of products, ultimately affecting their market price and demand. This is because a strong brand often commands a premium price compared to generic alternatives. As a result, the financial value of inventory can be significantly influenced by branding.

Additionally, there are other scenarios where intangible factors play a crucial role in determining the value of inventory. These include:

- Market trends: Changes in consumer preferences can greatly impact the demand for certain products and, therefore, their value as inventory.

- Brand reputation: A strong brand can increase the value of inventory by ensuring higher sales and profitability.

- Intellectual property: Patents and trademarks can protect inventory from competition, maintaining its market exclusivity and value.

In these cases, it is important to recognize that inventory is not just a physical asset. Its value also depends on intangible factors such as branding and IP that influence its marketability and profitability.

So, businesses must not neglect these factors when valuing their inventory, as it can have a significant impact on their overall financial health.

The Timly Software in Use

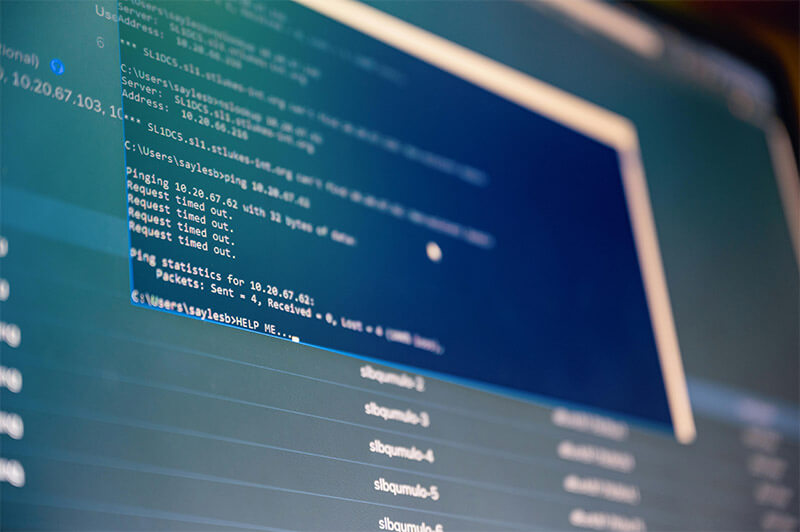

Optimized Device Management With Innovative Self-Inventory

SodaStream is the world market leader for water sparkling systems for domestic use and has a lot of IT equipment at its various locations. Many colleagues now work from their home offices. A digital solution for the efficient management of IT end devices became necessary...

Panasonic x Timly: Driving Technological Innovation

One of the most remarkable aspects of human ingenuity is our ability to innovate. Innovation is embedded in the DNA of consumer electronics giant Panasonic, which has diversified into a number of sectors, from heavy industry to construction...

Manage Video Equipment Efficiently Without Much Effort

The Hamburg media company always does outstanding journalistic work and is characterized by independent reporting. In order to maintain journalistic quality, the teams work with highly specialized devices – these need to be managed efficiently...

Smart City Asset Management – Timly in Use at DIGOOH

The core business of DIGOOH Media GmbH in Cologne is to manage digital city light posters (DCLP) for outdoor use in various cities in Germany. The challenge here lies in making the client’s communication message always available at the right time, in the right place...

(No credit card required)

Is Unsold Inventory an Asset?

Yes, unsold inventory is recorded as an asset on a company’s balance sheet. This is because it represents goods that are expected to be sold within a year and has the potential to generate revenue in the future.

However, having a large amount of unsold inventory can also significantly impact a company’s balance sheet. It can indicate inefficiencies in inventory management or market demand issues, potentially leading to financial strain if not managed effectively.

That’s why businesses employ strategies such as demand forecasting, strategic placement, and offering discounts or promotions to manage excess inventory. These measures not only help to stimulate sales but also minimize the negative impact of unsold inventory on a company’s balance sheet.

All this helps businesses maintain financial flexibility and improve profitability by ensuring that inventory remains an asset rather than becoming a liability.

Can Inventory Be a Liability?

Yes. Inventory can quickly turn into a liability if managed poorly. This is especially true when inventory becomes obsolete or excess. It results in financial strain through tied-up capital and storage costs.

The risk of obsolescence and expenses can significantly impact a company’s financial health, outweighing the potential revenue from selling the inventory.

Moreover, poor inventory management amplifies this issue by causing inefficiencies in cash flow and profitability. To prevent inventory from becoming a financial burden, it is crucial to manage it effectively.

By implementing effective management strategies, companies can ensure that their inventory remains an asset rather than a liability on their balance sheet.

What Is the Difference Between Inventory Asset and Cost of Goods Sold?

Inventory and cost of goods sold (COGS) are both critical aspects of a business’s financial operations. So, understanding the difference between them is crucial for effective inventory management and profitability.

On one hand, inventory is considered an asset because it represents goods or materials held for sale or in production. On the other hand, the cost of goods sold (COGS) is an expense that reflects the cost of inventory sold during a specific period.

COGS also plays a significant role in inventory valuation. By adjusting the cost of remaining inventory, it influences future COGS calculations and can impact profitability. Therefore, effective management of inventory as an asset is crucial to optimize COGS and maintain financial health.

Moreover, there is an important relationship between inventory turnover and COGS. A faster inventory turnover can lead to lower COGS due to reduced holding costs and risks of obsolescence.

Therefore, effective management of inventory as an asset is essential for optimizing COGS, maintaining financial stability, and successfully managing its operations.

How Changes In Market Demand Affect Inventory As An Asset

Changes in market demand greatly impact inventory as an asset and influence its value and liquidity with significant consequences. Especially for businesses, operating in industries where demand fluctuates frequently, such as retail and manufacturing.

The COVID-19 pandemic is a prime example of how unpredictable changes in consumer demand can disrupt inventory management and create imbalances.

To mitigate these risks and maximize the value of their inventory, businesses often adjust their valuation strategies based on market trends. Thus, this may involve regularly reevaluating inventory values using methods like Lower Cost or Market (LCM) or Net Realizable Value (NRV).

The key adjustment strategies include:

- Inventory Revaluation: Updating inventory values to reflect current market conditions.

- Demand Forecasting: Using historical data and market trends to predict future demand.

- Supply Chain Optimization: Aligning production and distribution with anticipated demand.

By actively implementing these strategies, companies can better align production and distribution with anticipated market demands. This helps maintain inventory value and liquidity and ensures it remains an asset that supports overall business operations.

Frequently Asked Questions About Is Inventory an Asset?

Is Inventory an Asset or Not?

Yes, inventory is considered a current asset because it represents goods or materials that are either held for sale or in production and are expected to be converted into cash within a year. In other words, inventory is a valuable resource that supports business operations and contributes to revenue generation.

Is Merchandise Inventory a Current Asset?

Absolutely. Merchandise inventory falls under the category of current assets as it is expected to be sold within a year. This makes it an essential component in maintaining liquidity and fulfilling short-term financial obligations for a company. Therefore, merchandise inventory holds significant value in determining the financial health of a business.

Recommended for you:

Book an online demo - free and without obligation - or create your free trial account directly.